To stand out, organizations must constantly monitor trends, reinvent themselves, and innovate

This article was provided by Normandin Beaudry

In today’s dynamic workplace, organizations must constantly monitor trends, reinvent themselves, and innovate to stand out from their competitors as it relates to total rewards.

They should also be mindful that employee needs change and evolve throughout their career.

For many organizations, this work can feel daunting which is why Normandin Beaudry has created data-backed recommendations for each career stage.

Normandin Beaudry’s remun, Canada’s most comprehensive total rewards survey, found that salary increases are more meaningful and higher early on in an employee’s career. For instance, an employee in a professional or technician level job may experience an average annual increase upwards of 6% during their initial years, and then that number tapers to 4% per year.

“At the beginning of a career, the learning curve to master the current job is steeper and that is why we tend to see higher salary increases,” explains Geneviève Cloutier, Partner, Compensation and Performance at Normandin Beaudry.

Although competitive salaries are important in attracting and retaining talent, it is not the sole motivation for today’s employees. Data results from remun indicate that the primary reason for resignation is due to a lack of challenge and career progression. That’s where organizations come in as they play an important role in supporting employee goals and their career aspirations.

Cloutier adds: “There are a number of career advancement opportunities that surpass traditional promotions including entrusting employees with special projects or offering lateral movement, allowing them to explore other areas of expertise and business.”

Salary remains an important factor throughout the mid-career stage, but additional elements also come into consideration. Employees express the need for holistic benefits and seek out an integrated workplace culture that is willing and able to accommodate. Normandin Beaudry refers to this approach as ‘Health 360°’ as it encompasses the physical, psychological, financial, and social health of employees.

According to Normandin Beaudry’s 2023 remun survey, companies that implemented a health and wellness program experienced a 3-4% reduction in annual turnover compared to those that did not.

Cloutier explains that by offering such programs, “employers demonstrate a commitment to employee well-being, fostering greater loyalty and enabling personal growth.”

As employees begin to plan for their retirement, their primary concerns become financial security and peace of mind. Insights from remun data indicate that organizations struggle to align their total rewards packages with the requirements of future retirees.

"From the initial 2012 remun survey to the 2023 edition, we observed a shift in organizational priorities towards savings plans. The proportion of organizations offering Defined Benefit Plans (DB plan) decreased from 25% to 11%," explains Maxime Cardinal, Senior Principal, Investment Consulting and Pension at Normandin Beaudry.

He adds: "It has become increasingly challenging for employers to shoulder the costs and allocate resources needed to manage a DB plan. Consequently, organizations are favouring savings plans, such as group Registered Retirement Savings Plans (RRSPs). RRSPs provide employers with simple and efficient means for employees to financially prepare for retirement."

However, these solutions impose significant responsibilities on employees, including saving an adequate amount of money, making investment decisions, and managing longevity risk.

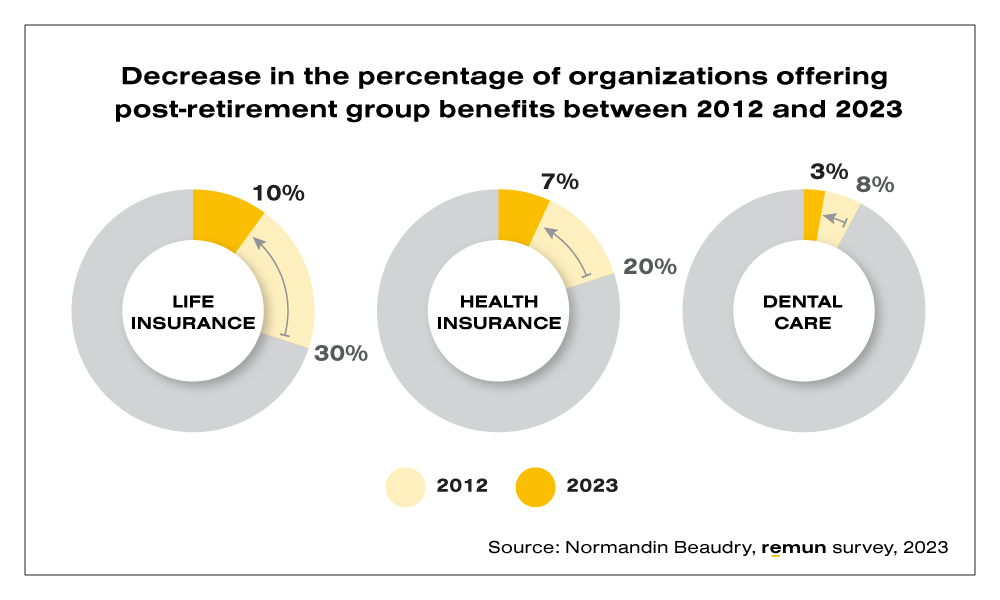

Post-retirement group benefits plans are becoming increasingly scarce. Based on remun survey responses, the percentage of organizations providing a post-retirement group benefits plan has plummeted by two-thirds since 2012. Specifically, the availability of post-retirement life insurance has declined from 30% to 10%, health insurance from 20% to 7%, and dental care from 8% to 3% between 2012 and 2023.

“Today’s retirees still need a predictable and guaranteed source of income and financial protection such as those offered by an annuity, travel insurance, health insurance, etc.,” explains Mr. Cardinal. “To meet this need, employers have access to solutions without incurring operational or financial burdens."

These solutions are not limited to employees at early career stages but can also be extended to those hired mid-career or later. “DB plans were originally intended for employees expecting to spend a significant portion of their career with the same organization to maximize their years of service under the plan,” Cardinal continues.

However, organizations offering a combination of a group RRSP during their career with the option to purchase an annuity during retirement have designed a solution similar to a DB plan for employees, with no drawbacks for the employer. This arrangement ensures retirees can rely on a stable income sheltered from market volatility.

Organizations are perpetually striving to adapt and meet the evolving needs of their employees. Extending the same consideration to retirees can prove advantageous, as they often become influential employer brand advocates. In fact, many organizations now leverage a network of candidates driven by retirees.

Utilizing reliable data and identifying trends serve as a cornerstone for strategic positioning against competitors. These approaches not only aid in establishing actionable priorities but also facilitate the development of scalable and relevant total rewards, extending beyond the conclusion of one's career.

In a dynamic professional landscape, organizations that prioritize the holistic well-being of their employees throughout their career will not only thrive in the competition for talent but also build a legacy of trust and support that extends far beyond the confines of the workplace. By leveraging comprehensive data insights, organizations can tailor their total rewards strategies to meet the diverse needs of employees at every stage of their careers.

Geneviève Cloutier, CHRP Fellow Distinction, Partner, Compensation / Practice Leader Performance at Normandin Beaudry

Geneviève Cloutier, CHRP Fellow Distinction, Partner, Compensation / Practice Leader Performance at Normandin Beaudry

Maxime Cardinal, Senior Principal, Investment Consulting and Pension at Normandin Beaudry

Maxime Cardinal, Senior Principal, Investment Consulting and Pension at Normandin Beaudry