Notable differences between men, women for salaries, superannuation, savings

Australians may often wonder how their finances compare to others, and recent data compiled by Canstar provides insights into the average earnings, savings, debts, and superannuation balances across different age groups.

According to the report, Australians' financial health varies significantly depending on age, gender, and employment status.

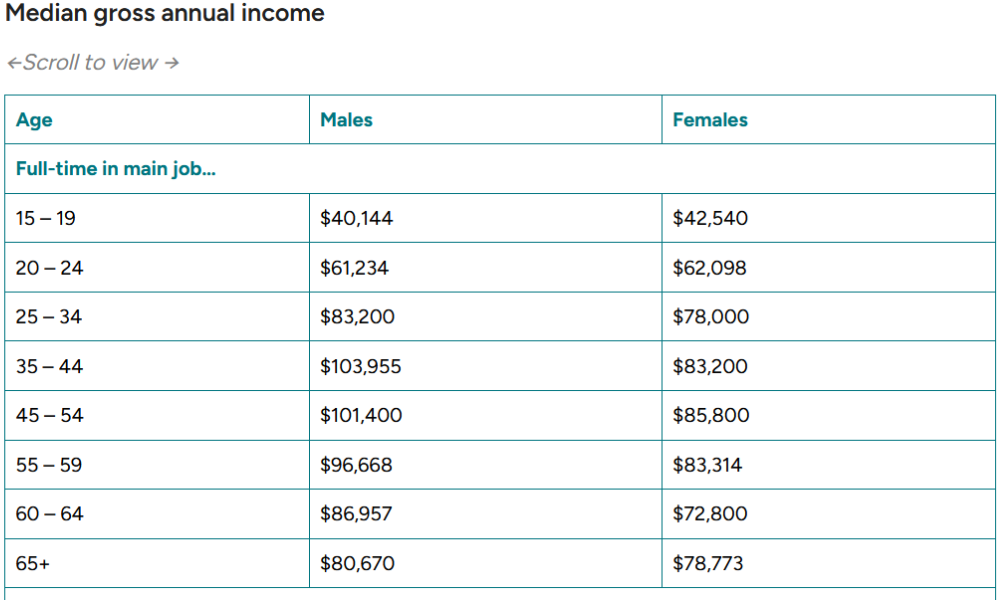

For full-time workers, men aged 45-54 earn an average of over $101,000 per year before tax, while women in the same age bracket earn around $85,800.

Meanwhile, younger workers in the 20-24 age group bring in just over $60,000 annually on average, said the Canstar report.

Male workers aged 15 to 19 make an average salary of $40,144, while men aged 20 to 24 earn an average $61,234.

Women in the same age brackets earn $42,540 and $62,098 on average respectively — or a difference in their favour of $2396 and $864.

In the 25 to 34 age bracket, men earn $83,200 on average which is $5200 more in their pockets on average than women the same age, who earn $78,000 in comparison.

Part-time workers, unsurprisingly, report lower figures. Those aged 45-54 earn about $43,000 for both men and women. Overall, the median gross annual income tends to rise with age, peaking in the middle-aged categories before tapering off for older workers nearing retirement.

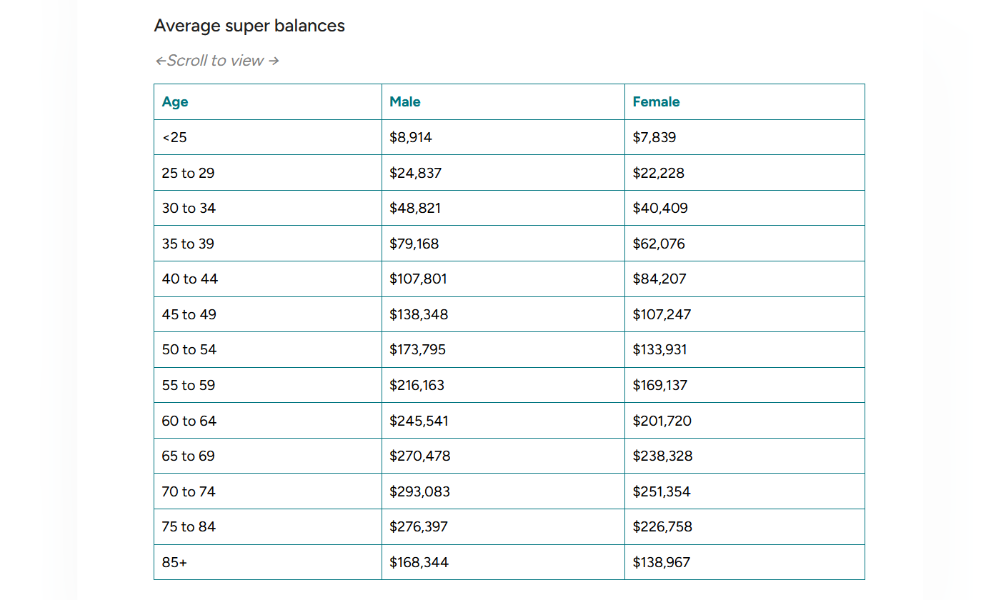

Superannuation balances are a critical aspect of long-term financial planning for Australians. According to the Canstar report, men aged 60-64 have an average super balance of $245,541, while women in the same age group hold $201,720.

Across all age groups, men tend to have higher super balances than women, which may reflect disparities in income and workforce participation over time.

Savings habits in Australia vary based on age, with individuals aged 30-39 leading the pack by setting aside an average of $344 per month. By contrast, those over 70 save an average of $288 monthly.

The total value of savings and investments also shifts significantly across age brackets, says Canstar. Australians aged 50-59 have the highest average savings, with a total of $14,225 set aside, while younger Australians, aged 18-29, hold about $7,688 in savings and investments.

However, debt is another major factor in the financial landscape of Australians. The average Australian has $3,869 in credit card debt, and $8,981 in personal loans.

When it comes to mortgages, the average home loan for Australians stands at $607,963, with New South Wales having the highest average mortgage of $744,101, and Tasmania the lowest at $461,961, finds Canstar.